Brought to you by Sarah Downes at REPIC Ltd a WEEE Producer Compliance Scheme in the UK

Executive Summary

Despite the differences in criticality definitions in the United Kingdom and EU, the approach being undertaken within FutuRaM will ensure that data can be produced which is relevant to the UK list. The data will be housed in a new Secondary Raw Material –Knowledge Base (final user-friendly name to be agreed!), giving access to UK stakeholders on historical, current and future secondary raw materials availability.

The UNFC is an international framework of relevance to the UK. FutuRaM will develop this framework and undertake case studies within the UK. The mass balance case study we are undertaking on WEEE could help to address some of the questions raised around CMs in the recent call for evidence under the WEEE Regulations review.

The UK and EU have common needs and clear strategies for improving data and intelligence. FutuRaM will help to address these needs and provides a space for European researchers to collaborate.

Materials or Minerals? What’s in a Name?

Raw materials or minerals are vitally important across Europe to help us create the energy infrastructure to transition to a low carbon economy. They are also essential to digitalisation, automotive, renewable energy, defence, aerospace, and our growing reliance on electronics.

But since leaving the EU, what materials are considered critical to UK industry, being of strategic economic importance, and facing supply chain vulnerability? How does this list differ to the EU? How is the UK addressing their needs for better data and intelligence? And how the FutuRaM project is highly relevant in addressing those needs and adding value; producing data which supports UK research needs, further developing the UNFC (United Nations Framework Classification for Resources) in classifying and harmonising critical mineral resource data and undertaking UK case studies; and providing a network for European researchers to collaborate.

From materials to minerals: materials are commodities that are used in manufacturing; minerals are substances which are found in the Earth. A mineral resource is a concentration or occurrence of materials of economic interest whilst a mineral reserve is the economically mineable part of the mineral resource (more about this later). In the EU, the term critical raw materials (CRMs) is used, whilst in the UK we have moved to the term critical minerals.

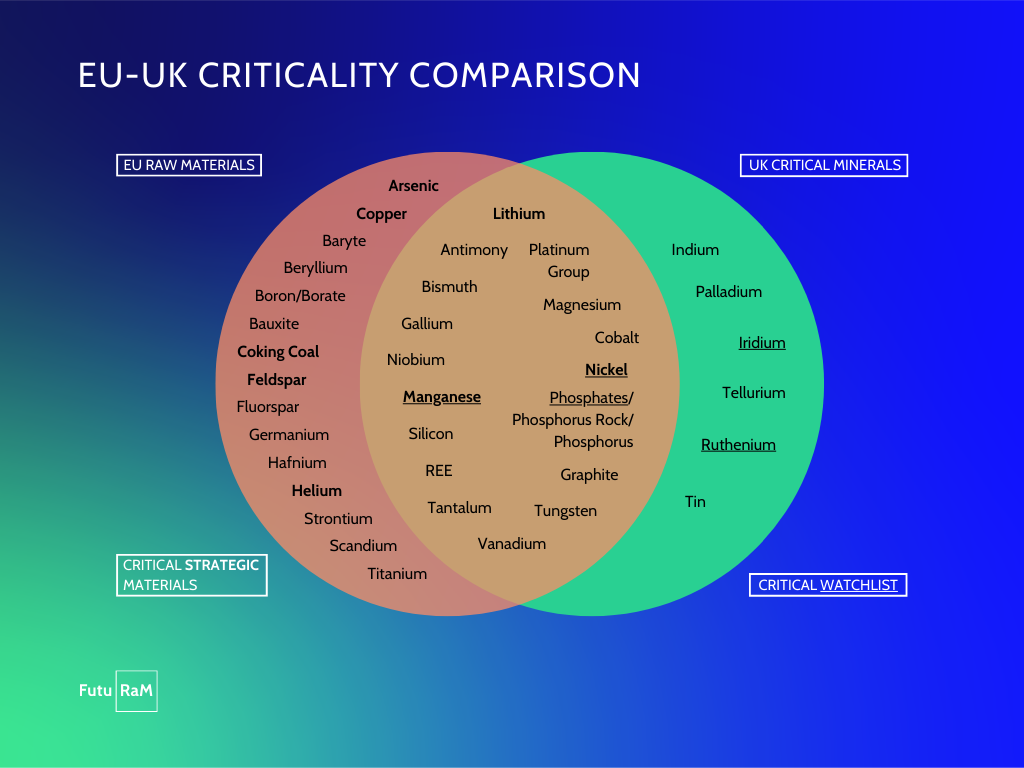

Whilst minerals and materials face common demand and supply challenges; there are now differences between the UK and the EU in the scope of what is deemed critical, and the policy and regulatory framework established to deal with this. Differences in national priorities are nothing new or uncommon. Another universal challenge is the data available to determine criticality. The EIT (European Institute of Innovation & Technology) Raw Materials project IRTC (“International Round Table on Materials Criticality”) has started to tackle questions surrounding methodology, application, and future development of raw material criticality assessments.

A New UK Critical Minerals Strategy – What Minerals are Critical?

The first UK Critical Raw Materials Strategy was published by the UK Government in 2022.

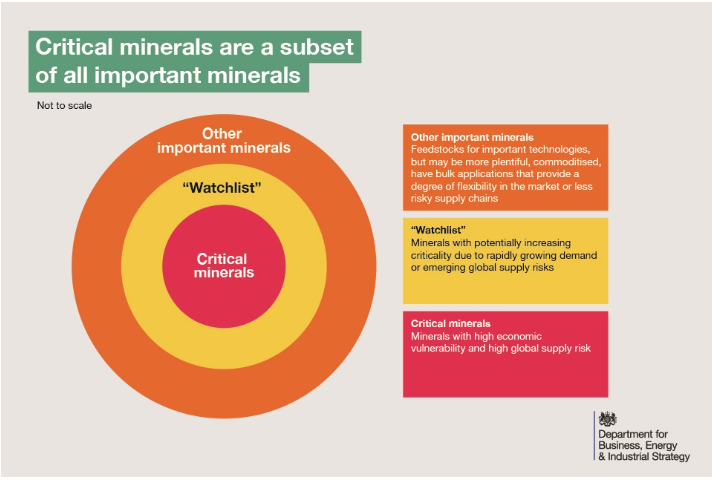

As one of the new strategic approaches, a new Critical Minerals Intelligence Centre (CMIC) has been established, hosted by the British Geological Survey (BGS) One of CMIC’s first outputs was a criticality assessment in which it defined a cohort of minerals with high criticality based on economic vulnerability and supply risk. Figure 1 shows how minerals are classified in the strategy.

Critical Minerals and the Overlap with Critical Raw Materials

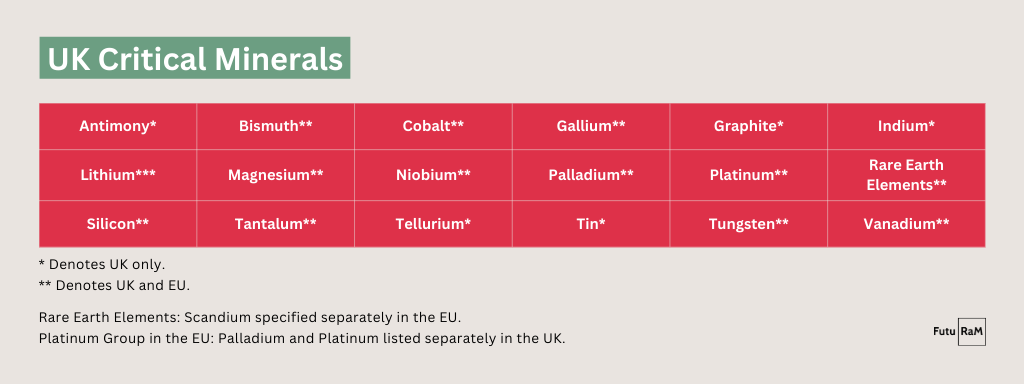

The tables below show which minerals are considered critical in the UK and how this compares with criticality in the EU. Of note, is that all Rare Earth Elements (REEs) are included.

The First Watchlist

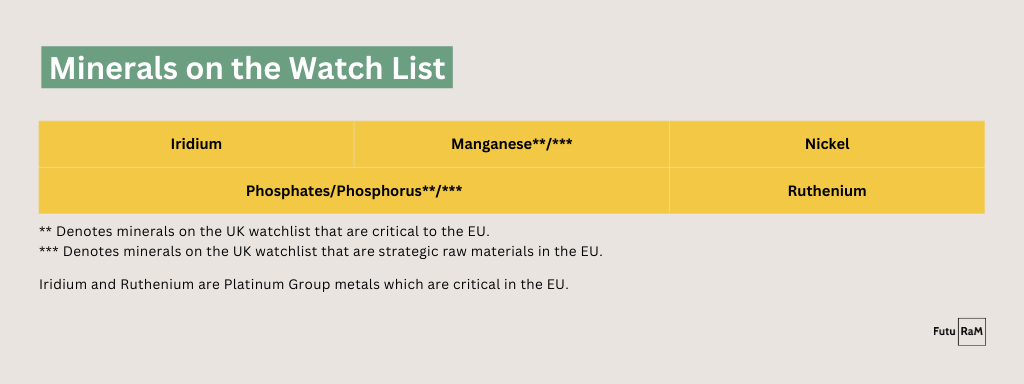

In the UK there is also a watchlist which consists of minerals that are increasing in criticality and may be impacted upon by sudden market or supply shocks or are becoming more critical over time due to additional demand or supply chain trends.

Nickel is given as an example of a commodity traded in large global markets for a diverse range of applications and having supply chains a degree of resilience. However, Russia is a major supplier, and Russia’s invasion of Ukraine caused significant disruption to nickel markets. Class 1 (high purity) nickel is an important metal for electric vehicle batteries, and the criticality of nickel may rise with the on-going war in Ukraine.

Materials Considered Critical in the EU but Not in the UK

There are some materials which are considered critical or strategic in the EU but not in the UK. This may be related to the methodology used and /or differences in economic priorities. The UK does not list its important materials but it’s logical to conclude that copper and aluminium are important.

FutuRaM Materials

There are a number of overlaps in criticality and taking into account the wider list of important minerals, generally speaking, many of the same materials are of concern, except for Indium and Tin which are not considered critical in the EU.

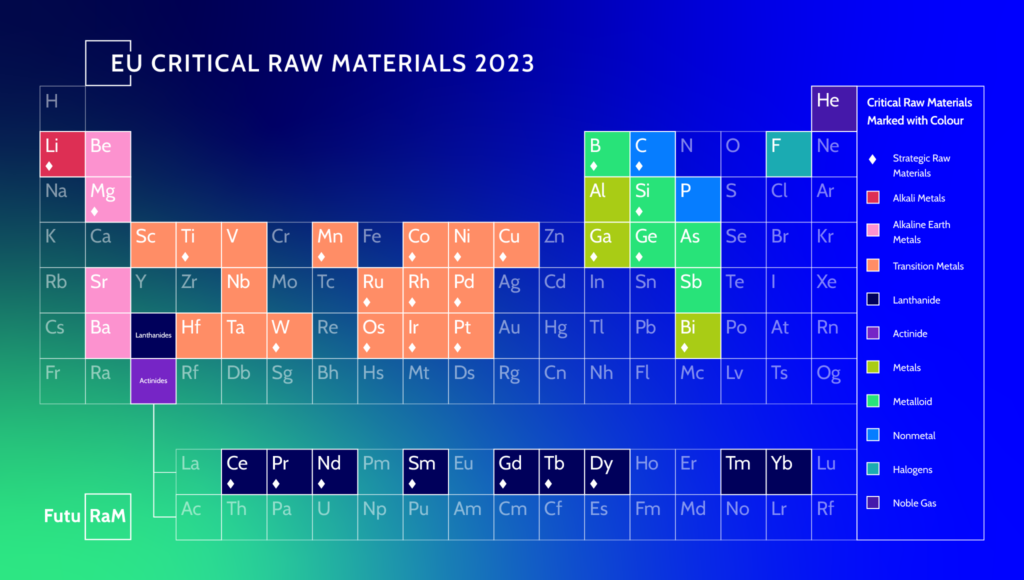

The FutuRaM project is focused on CRMs and what the EU terms Strategic Raw Materials, which are a subset of CRMs deemed to be of particularly high strategic importance (see the periodic table below). Whilst Indium and Tin are not priorities for data gathering, the product mass balance approach we are taking to determine what is recovered and available for recovery means that available data on Indium and Tin will be included in the knowledge platform produced.

As an example, in looking at material recovery from waste electrical and electronic equipment (WEEE), flat panel TVs contain Indium Tin Oxide, and data will be collated on recovery rates for TVs. The same can be said for other waste streams where the project researchers consider the full mass balance for material recovery.

How Can the Outputs from FutuRaM Support the Delivery of the Critical Minerals Strategy?

Providing Data and a New Knowledge Base

The Critical Minerals Strategy sets out UK aims and objectives to accelerate domestic capabilities. This includes carrying out cutting edge research and development; and accelerating a circular economy for critical minerals – increasing recovery, reuse and recycling rates and resource efficiency.

The FutuRaM project is developing a methodology, reporting structure, and guidance to improve the raw materials knowledge base for the whole of Europe up to 2050. The aim of the FutuRaM knowledge base is to facilitate the exploitation of secondary raw materials (2RMs) with a particular focus on CRMs. A new 2RM–Knowledge Base (2RM-KB) will house historical, current and future projections of the availability and recoverability of 2RMs arising from WEEE, end of live vehicles (ELVs), Batteries, Slags and Ashes, Mining Wastes, and Construction and Demolition Wastes. This will also become a resource for UK to facilitate commercial exploitation of 2RMs and CRMs by manufacturers, recyclers, and investors, and support policy makers and government and their agencies.

Supporting Research and Development (R&D) and UK Research and Innovation (UKRI)

UK Government is supporting R&D through UK Research and Innovation (UKRI), a co-funder in FutuRaM.

UKRI has also invested in the National Interdisciplinary Circular Economy Research (NICER) Programme – a £30 million programme to support a circular economy hub and five centres of excellence on circular metals, technology metals, chemicals, construction and textiles across the United Kingdom. As part of this initiative, Met4Tech, the Circular Economy Centre for Technology Metals is bringing together academic and industrial partners to identify system-level interventions to enable circularity in the production, use and reuse of technology metals. The Centre works with partners to join up along the value chain to deliver improved resource use and waste minimisation and develop a new technology metals circular economy roadmap.

The CLIMATES (Circular Critical Materials Supply Chains) programme is a £15 million investment, being delivered by Innovate UK. CLIMATES aims to increase UK supply chain resilience within critical minerals, with an initial focus on Rare Earth Elements (REE), for applications such as permanent magnets

FutuRaM will collaborate with UKRI, Innovate UK and their partner initiatives to share knowledge and understand their data needs. Innovate UK sit on the advisory board of the FutuRaM project, so we are well placed to foster collaboration.

The Critical Minerals Intelligence Centre (CMIC)

The CMIC has been established to provide market intelligence and data and analysis on sources of the supply, demand and market dynamics of critical minerals, as well as insights on factors affecting these markets. BGS will work with partners from across industry and academia, in the UK and overseas, to provide the required research and analysis.

FutuRaM will be producing data which will be of use to BGS and the CMIC and is engaging with them to establish how we can meet their needs from the new 2RM-KB. BGS are a member of EuroGeoSurveys and a number of National Geological Surveys are partners in FutuRaM. There are well established relationships in place across Europe. Moreover, the Critical Raw Materials Act (CRMA) in the EU will require Member States to develop CRM observatories and national policies on research and innovation. Many of these observatories will be delivered by National Geological Surveys and will work collaboratively with FutuRaM.

United Nations Framework Classification (UNFC) in Classifying and Harmonising Critical Mineral Resource Data

UK Government will publish a review of current global activities, research and policy leading to the identification of the key issues related to critical mineral resource management and the sustainability of supply. This will include an evaluation of the role of the United Nations Framework Classification for Resources (UNFC) in classifying and harmonising critical mineral resource data and discuss potential application of the United Nations Resource Management System (UNRMS).

FutuRaM is looking at UNFC as a tool to support the exploitation of 2RMs. The UNFC is a principle-based classification system for the transparent communication of the availability of mineral and energy resources. It aims to take a holistic view of resource availability, with classification of recovery projects on three axes:

- socio-economic-environmental viability;

- technical feasibility;

- and the degree of confidence in estimates of recoverable quantities.

Implementation of the UNFC by practitioners is currently hindered by a lack of guidance regarding the detailed methodologies for social and environmental sustainability, and an absence of reporting standards and case studies that demonstrate the assessment and reporting.

By providing guidance and case studies for the classification of 2RMs aligned with the UNFC, FutuRaM will provide a tool that can be used to communicate 2RM availability for exploitation to industry and their investors, government, and regulators, etc., providing transparent and consistent information.

FutuRaM will develop and test the UNFC methodology for 19 case studies across Europe for the six FutuRaM waste streams. The case studies will test and further develop the UNFC method and gather data for its applicability to each of them. Three case studies will be undertaken in the UK, one on C&D wastes, one focussing on waste timber, and the one REPIC is participating in, a UK WEEE Mass Balance. This work is just starting, and we will be engaging with the WEEE recycling sector to establish the inputs and outputs for 2RMs and CRMs and where the potential lies for future recoverability. Watch this space!

The Implications of New EU Legislation on UK Industry

New legislation is coming into force in the EU, and whilst not applicable to the UK, the legislation will impact on global supply and to all products sold in the EU. The Ecodesign for Sustainable Products Regulation will apply to all products placed on the EU market, whether produced inside or outside the EU. It includes provisions for a new “Digital Product Passport” to provide information about products’ environmental sustainability. This information will be easily accessible by scanning a data carrier and it will include attributes such as the durability and reparability, the recycled content or the availability of spare parts of a product.

The CRMA will be far reaching. Of note in the WEEE sector, it will require the declaration of post-consumer Neodymium in products containing magnets, and after 2030 may mandate for recycled content. It will require member states to increase the reuse of components and products with high CRM content, and to report on the removal of components high in CRMs. Many products containing neodymium magnets will have to contain a unique product identifier.

FutuRaM is developing future scenarios to forecast how secondary raw materials availability and recoverability could change in future. These scenarios consider the impact of policy development and technology changes.

At REPIC, we regularly update our electrical and electronic equipment (EEE) producer members on our project work and will be looking to work more closely with our WEEE recycling partners on FutuRaM in future.

FutuRaM UK Partners

UK project partners include REPIC Ltd, University College London (now a partner in the UN backed International Centre of Excellence on Sustainable Resource Management in the Circular Economy), MACE and EMR who are focussed on construction and demolition waste and battery waste, respectively. REPIC Ltd are a WEEE Producer Compliance Scheme and our role in the project is to provide expertise on WEEE product and material flows.

The Project Advisory Board includes the British Geological Survey and Innovate UK.