Brought to you by Antje Wittenberg from BGR

Every so often, one hears and reads about critical raw materials, but do we all know why critical raw materials are of interest, what those critical raw materials are, how are raw materials categorised as critical in the EU, what do role secondary raw materials play in the “concert of criticality”, and even more importantly, how to overcome this criticality?

Why are critical raw materials of interest?

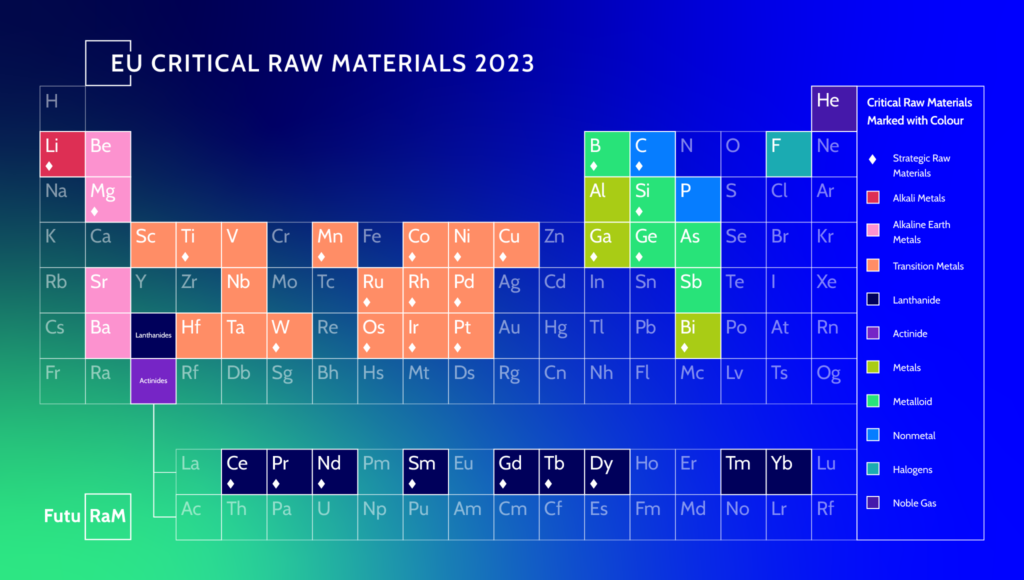

Organisations worldwide take increasingly notice of the importance raw materials play in our daily life. All industries across the supply chain depend on raw materials that are also of strategic importance since our digital and modern-day economy relies on products largely made from critical raw materials. Critical Raw Materials (CRMs) are key components in e.g. smart devices, green technologies, pharmaceuticals, and medical instruments. In the last decades, we used more and more of the entire periodic table of elements in our products in mostly very small but crucial amounts, which allowed miniaturisation and increased functionality.

The transformation of our industry and society, and the net-zero economy demands even more of those critical raw materials as highlighted by both the UN and the European Green Deal. The number of batteries needed for electric vehicles will significantly increase the global demand, as it is currently the case for Lithium. Critical raw materials such as Lithium, Nickel, Manganese, Cobalt, Phosphorous, and Silicon are used in common battery technologies, while the demand for the respective critical raw material depends of the type of battery technology dominating the market. Moreover, the energy sector and digitization require significant amounts of several critical raw materials, among those the rare earth elements (REE).

How are raw materials categorised as critical?

Caused by increasing tensions on the global market that hampered free and fair trade, the EU Raw Materials Initiative of 2008 launched the first assessment of production, market and technological developments that may distort access of raw materials for the European Industry. Factors such as economic importance, supply risk , import reliance , end-of-life recycling input rate , and specific substitution index are used to calculate the level of criticality since 2017 based on a revised methodology for establishing the EU list of critical raw materials. Thus, a periodical assessment takes place since 2011 that results in frequent updates of the critical raw materials list.

What are those critical raw materials?

Raw materials that are of high importance to the EU economy and at the same time are associated with a high risk of supply are defined as critical raw materials for the EU.

The first CRM list of 2011 identified 14 raw materials as critical with some of them grouped together. The most recent assessment of 2023 labels 34 raw materials as critical. There is a persistently high risk for rare earths, which are extremely dependent on imports from a single country at every stage of the supply chain. The European Union fully relies on China’s supply of heavy rare earth elements that are essential for Europe’s rapid technological advancement. Similarly high is the EU supply dependency on Boron (used in e.g. fiberglass) from Turkey (99 %).

What role do secondary raw materials play in circularity?

Secondary raw materials are recycled materials that can be used in manufacturing processes instead of or alongside virgin raw materials.

High quality recycling is an important process to increase Europe’s raw material assets. Albeit the fact that every raw material that can be recycled needs to be mined or grown first. The New Circular Economy Action Plan stimulates the production of CRMs by enhancing recycling activities, including suitable and improved treatment processes in the EU and fostering efficient use and recycling of critical raw materials. However, keeping the material in the loop depends among others on products designed for dismantling and recycling, sufficient collection of used materials, sorting, and processing to improve the low recycling rates of today.

How to overcome criticality?

The European Critical Raw Materials Act (CRM Act) provides a “comprehensive response to the risks of critical raw materials supply disruption and the structural vulnerabilities of EU critical raw materials supply chains.” The aim of the CRM Act is to ensure that the EU relies on its domestic resources – primary and secondary –while reducing its dependence on third countries to access critical raw materials. It calls on Member States to set up national exploration programs.

The CRM Act identifies a list of strategic raw materials, which are crucial to technologies important to Europe’s green and digital ambitions and for defence and space applications that are subject to potential supply risks in the future. Most of those strategic raw materials are critical as well. The CRM Act sets a couple of objectives with benchmarks for 2030 for these strategic and critical raw materials:

- EU extraction: at least 10 % of the EU’s annual consumption from extraction within the EU;

- EU processing: at least 40 % of the EU’s annual consumption from processing within the EU;

- EU recycling: at least 25 % of the EU’s annual consumption from domestic recycling;

- External sources: not more than 65 % of the EU’s annual consumption of each strategic raw material at any relevant stage of processing from a single third country.

The CRM Act zooms in on where Europe’s resilience is at risk regardless of the stage of the process chain – from exploration, mining, purification, processing, and semi-finished production up to recycling.